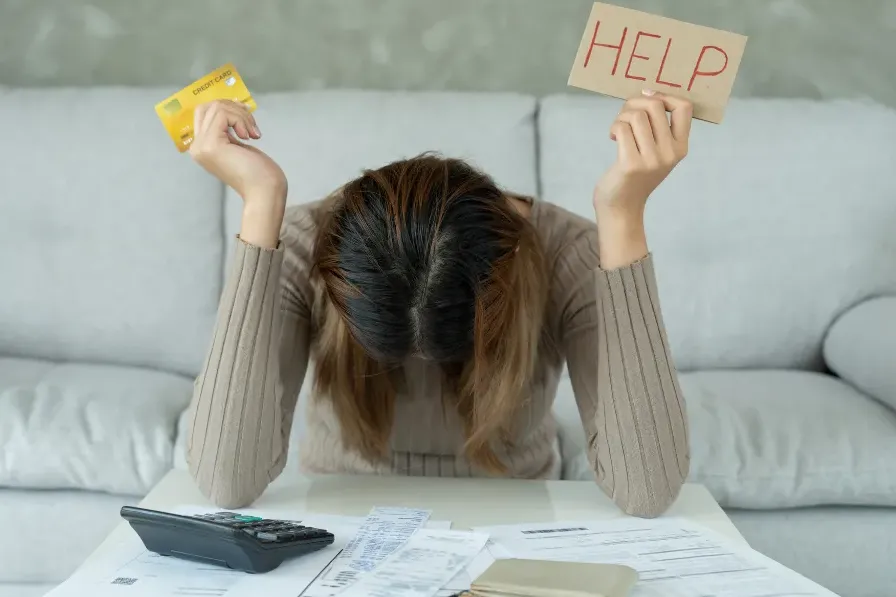

HELP EMPLOYEES BREAK FREE FROM DEBT &

Boost Their Focus At Work

Why It Works:

Relieves financial stress

Increases productivity and focus

Enhances employee retention

NO COST TO THE COMPANY AND 100% CONFIDENTIAL

Give Your Employees

a Benefit to Find Solutions for their Debt!

(1)

Tell Us About Your Debt

Talk to one of our Debt Specialist to discuss what is most concerning to you about your debt.

(2)

Discover Your Savings

Find out how to lower your monthly debt payments, save on time and get you on a customized strategy.

(3)

Execute Debt Relief & Solutions

Work with our network of experts and professional to get your strategy executed towards to your deft free life.

If your employees are struggling with this type of debt, we’re here to help!

Credit

Cards

Medical

Bills

Studen Loans

Cash Advance

Loans

Commercial

Banks

Credit

Cards

Medical

Bills

Studen Loans

Cash Advance

Loans

Commercial

Banks

Solar Panels

Financing

Merchant Cash

Advance

Furniture

Loans

Credit

Unions Loans

Payday

Loans

Business

Debts

Time

Shares

Department

Store Accounts

Auto

Loans

Gas

Cards

Credit

Cards

Medical

Bills

Student Loans

Cash Advance

Loans

Commercial

Banks

Solar Panels

Financing

Merchant Cash Advance

Furniture Loans

Credit Unions Loans

Payday

Loans

Business

Debts

Time

Shares

Department

Store Accounts

Auto

Loans

Gas

Loans

The Real Costs of Employee's Financial Stress

68% of American workers experience financial stress, with those under 30 at 78%.

Debt and unexpected costs affect overall well-being and performance.

Debt and Unexpected Costs

Financial struggles create stress, affecting employees’ health, productivity, and focus.

Health Issues and Absenteeism

Stress-related health problems lead to more frequent sick days, increasing absenteeism.

Distractions and Reduced Productivity

Financial worries cause distractions, reducing employee efficiency and increasing errors.

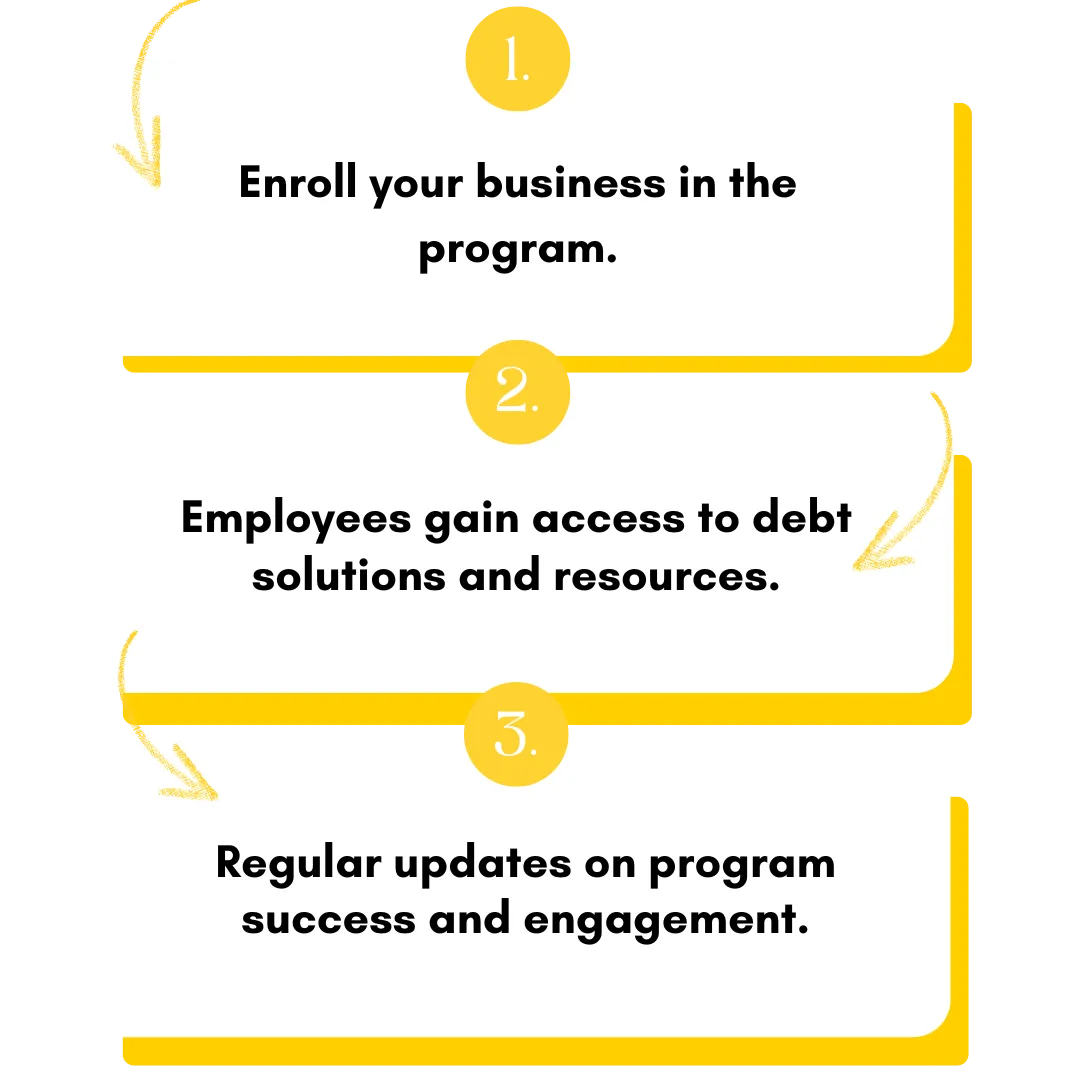

3 Simple Steps to Empower Your Employees

We Equip Your Employees with Tools to Eliminate Debt, Reduce Stress, and Stay Focused on Their Work.

Program Benefits for Employers

Employees burdened by debt are less focused and more likely to leave.

If they have over $7,000 in unsecured debt—like medical bills, credit cards, or student loans—we can reduce payments by 40-60%, putting them back on track financially. This is a legal solution, not an educational course, to solve the problem and help your team thrive.

Financial stress has made its way into the workplace in more ways than many of us may realize.

But don’t worry—we’ve got the solutions!

Let us handle the stress so your team

can focus on success

DEBT IS TEMPORARY, IT IS NOT AN IDENTITY!

© Help Your Employees Out of Debt ALL RIGHTS RESERVED

Disclaimer: Help Your Employees Out of Debt operates as a consulting service that assists individuals in evaluating and identifying tailored strategies to address their financial concerns. Help Your Employees Out of Debt relies on the expertise of its trained and knowledgeable specialists, many of whom hold relevant licenses and extensive experience, to provide tailored guidance to clients. While the company does not directly provide debt settlement, legal, financial, or tax advice, nor does it assume debts, make payments to creditors, or act as a lending institution, creditor, or debt collector, it offers personalized consultations to help clients assess their financial situations and explore suitable options. Recommendations and outcomes may vary based on individual circumstances and the decisions made by the client. While Help Your Employees Out of Debt’s specialists provide knowledgeable guidance tailored to each client’s financial situation, clients are ultimately responsible for consulting with licensed tax, legal, or financial professionals to fully understand the broader implications of any chosen strategy. For those without access to such professionals, Help Your Employees Out of Debt can provide referrals from its established network of trusted providers, if requested by the client. It is important to note that participation in certain financial programs may impact credit scores, involve collections activity, or result in other financial consequences. Help Your Employees Out of Debt operates exclusively as a consulting and referral service and assumes no liability for the actions, advice, or outcomes of referred providers. By utilizing the company’s services, clients accept full responsibility for reviewing and understanding all terms, conditions, and disclosures associated with any programs they choose to engage in. Help Your Employees Out of Debt's services constitutes agreement to these terms.

Privacy Policy | Terms & Conditions